dependent care fsa vs tax credit

Read more about the requirements here. Now the credit goes up to 8000 for one eligible dependent and up to 16000 for two or more eligible dependents.

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

In some cases you may be able to take advantage of both.

. For those with an AGI of 43000 and above the maximum credit was 600 for one child and 1200 for two or more. Also keep in mind that you may be eligible to take advantage of the federal tax credit for. This tax credit is claimed on the federal income tax return.

The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses though expense amount is reduced by whatever you pay through the FSA. This is my first time to see Dependent Care FSA rollover. Dependent-Care Credit A couple of tax breaks are available for working parents who pay for child care but youll have to choose one or the other.

Dependent Care Fsa Vs Child Care Tax Credit 2022. They took advantage of their employers full 10500 FSA benefit for tax-free childcare savings box 10 of W2. Dependent Care FSA vs Child Tax Credit 2021.

New credit provide 600 and row 26 original child tax credit and row 27 new tax credit provide 2000 the tax in row 29 original. As your income level increases the advantages become greater under the Dependent Care FSA. Due to the IRS use it or lose it rule you will forfeit any money remaining in your 2020 Dependent Care FSA after December 31 2020 if you have not filed a claim for it by March 31 2021.

Taxpayer receives a 20-35 tax credit for up to 3000 in expenses for one qualifying person and 6000 in expenses for two or more qualifying persons. Both the FSA and the credit results in a 20 tax savings. Estimate your expenses carefully.

Calculate an accurate Federal tax rate estimate here. Dependent Care FSA For 2021 the new American Rescue Plan Act ARPA increased the maximum amount that you can contribute to an employer-sponsored dependent care flexible spending account FSA from 5000 to 10500. These limits have historically made the Dependent Care FSA more advantageous than the Dependent Care Tax Credit for.

Dependent Care Spending Account. Enter your expected dependent care expenses for the year ahead. Even if things revert back to 2020 rules for dependent care expenses its close to a wash for the first 3k.

Keep in mind that each persons tax situation is unique therefore you may want to consult your tax advisor before enrollment. Your tax bracket how many dependents you have Generally those with lower income levels under 30000 annually will see a greater advantage to using the Child and Dependent Care Credit. 5000 is the maximum whether for one child or more.

Dependent Care FSA vs Dependent Care Credit 2021 Calculator. If you have two or more eligible. But like the Dependent Care FSA the American Rescue Plan Act ARPA has also increased the credit limits for the Child and Dependent Care tax credit for 2021.

The maximum credit for one child is 3000 per year or 6000 for two or more children not to exceed 6000. At approx 22 rate - that is 2310 savings. Income Tax Credit.

Instead the dependent care contribution is subtracted from the child care credit 3000 - 2000 1000 allowing you to claim a child care credit of 20 of 1000 amounting to 200. Not unless Congress passes another modification. Under the current law that applies in 2022 you get up to 5000 tax-free.

Use the charts below to help determine which option is best for you. Can I use both. The child care tax credit allows parents meeting certain criteria to set aside money for qualifying child care expenses.

The annual maximum pre-tax contribution may not exceed 5000 per year regardless of number of children. Dependent care benefits received from your employer reduces these amounts. Form 2441 should be filed along with your 2021 tax return to take advantage of the Dependent Care Tax Credit.

But you can take advantage of any combination of the dependent care FSA and the child and dependent care tax credit to maximize your total economic benefit. Flexible Spending Account vs. Approximate value of fully utilizing the Dependent Care Tax Credit in 2021.

Unlike the DC FSA the child care tax credit as its name implies is not a deduction but a credit. A amrucker CatInACrockPot this is good to know thank you. Child and Dependent Care Credit vs.

Approximate value of fully contributing up to your employers plan limit in a Dependent Care Flexible Spending Account in 2021. The child care credit was increased for 2021 only. This figure accounts for the pre.

Any contributions that you make to a dependent care FSA cannot be used for the child and dependent care tax credit and vice versa. For 2021 you could claim a child care credit of 50 of up to 8000 amounting to 4000. Dependent Care FSA.

Filers could claim up to 3000 of expenses for one child and up to 6000 for two or more resulting in a maximum available credit of 1050 and 2100 respectively. Approximate value of fully contributing up to your employers plan limit in a dependent care flexible spending account in 2021. Read about it here.

Dependent Care Tax Credit vs. What is the Dependent Care Tax Credit. It doesnt matter if it is coming from current contributions or a carryover.

Basically for each year you can choose the credit or the exclusion but not both. Plus 50 credit for the additional 5500 since 16K max qualifying expenses for 2 dependents. Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit.

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Saving For Future Medical Expenses Is A Must And There Are Two Tax Advantaged Ways To Help You Do It Here S What Money Saving Plan Money Plan Family Finance

Optimize Tax Savings From Dependent Care Fsa Child And Dependent Care Tax Credit Video In 2021 Tax Credits Childcare Costs White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Explore Our Image Of Dependent Care Fsa Nanny Receipt Template Receipt Template Receipt Templates

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

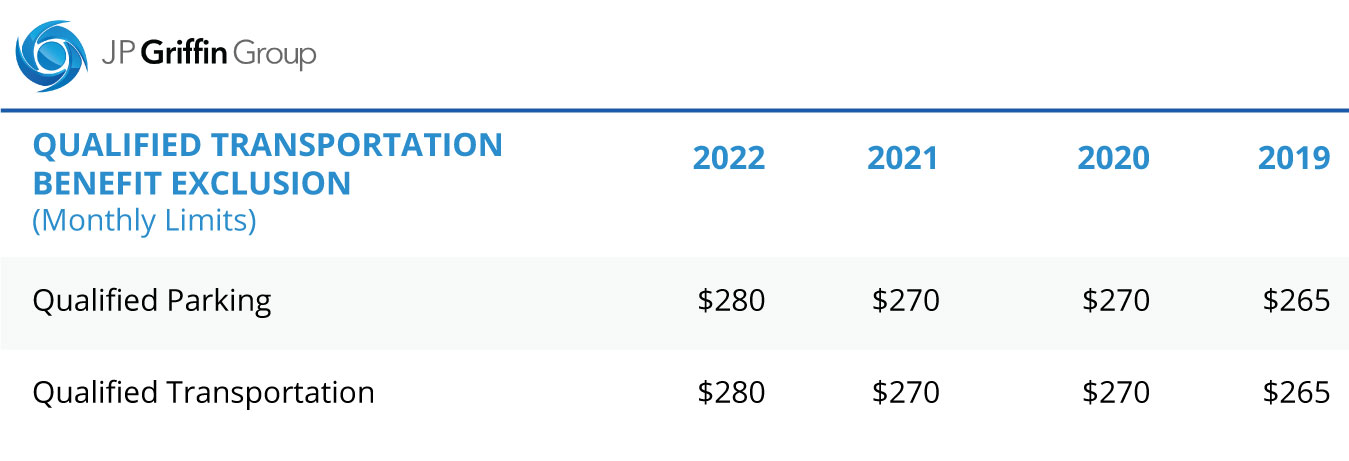

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Coronavirus And Dependent Care Fsa H R Block

How To Set Up A Dependent Care Fsa

I Made A Calculator To Help Parents Choose Between The Dc Fsa And The Dc Tax Credit For 2021 R Excel

What Is A Dependent Care Fsa Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Child Care Tax Savings 2021 Curious And Calculated

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning